We have published our Annual Report and Financial Statements for the year ended 31 July 2022. You can find the full report on our webpages.

We have published our Annual Report and Financial Statements for the year ended 31 July 2022. You can find the full report on our webpages.

Besides being able to welcome our students and staff back onto our campuses after the government’s lifting of COVID-19 restrictions and our outstanding performance in the Research Excellence Framework (REF 2021), there was much to celebrate in 2021/22. The Annual Report highlights some of the many brilliant achievements by colleagues, students and alumni over the last year, from research accomplishments and teaching awards to exceptional work in our local communities and in the international arena. Do take a look – it makes for a rewarding read and serves as a reminder of the fantastic work being done by our academics, Professional Services staff, students and graduates, day in and day out.

It’s only right that we also acknowledge the many challenges that we continue to face, both individually and institutionally. With that in mind, I wanted to present an update on the picture that our Annual Report and Financial Statements provide.

Our financial position

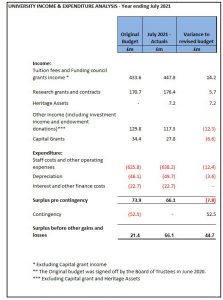

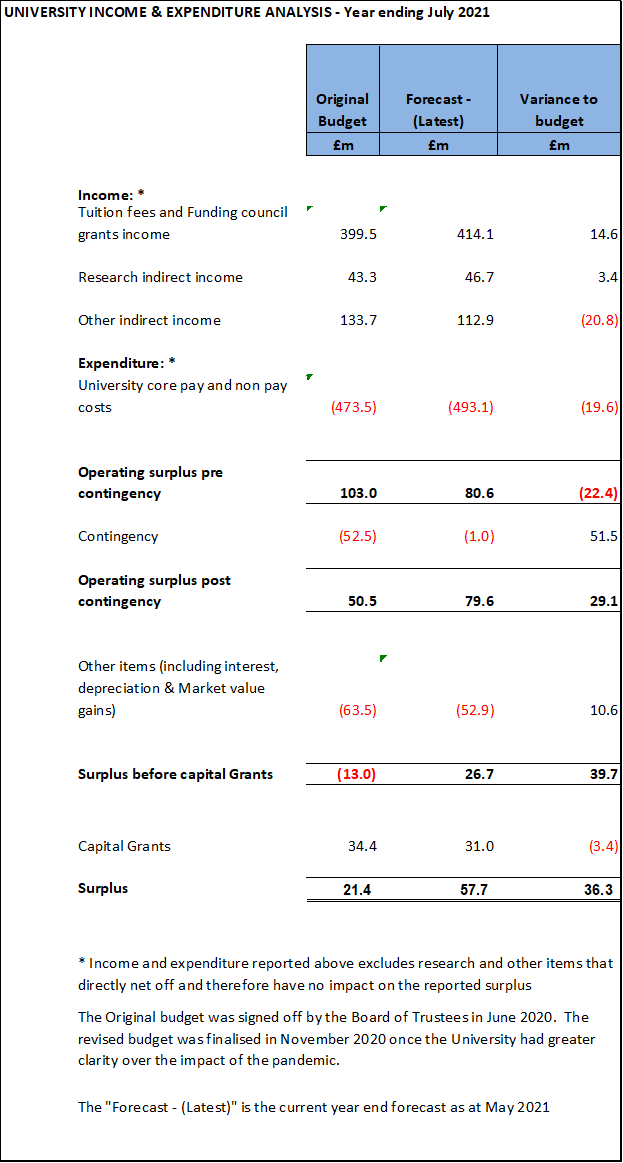

Our audited financial statements for the year ended 31 July 2022 report a deficit before other gains and losses (revaluation of our property and changes to the funding level of the UBPAS pension scheme) of £135.8 million compared to a prior-year surplus of £66.1 million. The deficit in 2022 was impacted by a significant one-off pension cost of £191.1 million following the agreement of the 2020 USS valuation. This significant charge reflects our best estimate of the cost of paying the USS past service deficit contributions that the University is contracted to make over the next 16 years at today’s prices.

USS has reported a significant improvement in the funding position of the scheme during 2022. There may be a reversal of this charge following the next valuation of USS on 31 March 2023 if the improvement in market conditions for defined benefit pension schemes persists over the coming month. We remain contracted to pay very significant past service deficit contributions to USS until a new valuation is completed. Adjusting for this one-off event would turn the reported deficit into a surplus before other gains and losses of £55.3 million, which would be more comparable with the prior year surplus of £66.1 million.

Our surpluses are used to maintain and replace our existing physical and digital infrastructure, including our student residences. We typically spend around £25 million each year maintaining what we have. Remaining cash is allocated to significant investments to replace or expand our education and research facilities. We are currently investing £35 million of our surpluses in a new clinical training facility for our dental students at Temple Quay. This will open in 2023 and will provide a much better learning environment for our students, provide free primary dental care to the local community and help to increase the number of dentists. We are also making investments in our North Somerset Campus at Langford to support a growth in veterinary students. There is a national shortage of both following Brexit, and we want to play our part in supporting the future of our communities.

Our investments have not only been in people (460 new jobs) and our campus facilities. We are also investing in our digital infrastructure. Last year we invested over £10 million in the delivery of our Digital Strategy. The early phases are focussing on ensuring that we have a resilient infrastructure that will enable colleagues and students to access our digital services in a secure manner from anywhere in the world. We are also providing new functionality to support our education and research. For example, we have recently launched the Self-Service Cloud, which enables members of our community to seamlessly access various cloud environments and reduce the need for local physical servers and networks on campus. We’ll shortly be embarking on a replacement of our entire campus IT network, both cabled and wireless, to substantially improve the digital experience.

Income and expenditure during 2022/23

Income grew by 10% in the year to £858.1 million (2021: £776.7 million) following growth across all key income streams. Student tuition fees grew 11% to £388.4 million (2021: £349.8 million) with income from international students showing the largest increase of 21%, reflecting continued high demand from overseas and our strategy to further internationalise our student body. Fee income from home students demonstrated a more modest increase of 4%.

Research grant and contract income grew by 9% to £192.8 million (2021: £176.4 million) with income from Research Councils growing by 12% and more than offsetting a 10% reduction in research income from UK-based charities who are taking longer to recover from the after-effects of the pandemic. It was very pleasing that we continued to grow research income, which is a good proxy for the amount of research we are undertaking, in line with our growth in student tuition fees.

Other income of £148.9 million showed growth of 18% (2021: £126.3 million) driven by a 58% increase in revenue from residences, catering and conferences. This reflected pre-pandemic levels of income with the 2021 comparative year having been significantly impacted by national lockdowns and by the decision to provide rent rebates to students adversely affected. Donations of £4.9 million recognised in the accounts (2021: £17.9 million) were significantly down but the prior year figures included a one-off, £7-million gift of scientific equipment and the £7-million recognition of donated heritage assets. It should be noted that total income from philanthropic sources last year was £29m – a record for the University. This support was recognised across multiple income streams including our research grants and contracts income and our endowment donations.

Staff costs, excluding one-off USS pensions costs, grew by 8%, which is broadly in line with our growth in tuition fees and research income. This increase is largely accounted for by the 460 new academic and Professional Services jobs created. These new jobs have helped us to address some workload challenges and provided opportunities for local people, as well as attracting further talent from overseas.

Other operating expenses were back to their pre-pandemic levels at £287.5 million, an increase of 24% on the prior year (2021: £231.9 million) where, owing to the impact of the pandemic, expenditure had been prioritised primarily on staff and students and essential operation of the estate.

Now and looking to the future

Financial margins for the new academic and financial year that we are now in, and for the next few years to come, are a lot tighter than they’ve been in recent history. We aim to keep our core education and research activities in a ‘break even’ position, excluding grant monies we receive for capital assets, any investment gains and losses on the Bristol Endowment Funds, and any valuation changes for both the properties we use and staff pension schemes. This is a tough challenge given the lack of any prospect of our largest income stream – home undergraduate tuition fees – being raised in the foreseeable future, alongside significant cost inflation. We are acutely aware of the impact of inflation on our students and staff. Our key objectives are to support the whole University community through these challenging times, to preserve jobs, and to make sure that we take opportunities and make investment decisions that will help ensure the medium-to-long-term success of our institution.

It is likely that we will continue to grow our academic endeavour over the coming years as we build on the success of the excellent REF 2021 results and many people from both home and overseas want to come and study and our institution. Further growth is not without its challenges, and it needs to be the right growth that helps us to achieve our academic potential. However, growth represents a considerably lower set of risks and issues than standing still or shrinking. It will not be possible to retain our existing broad academic endeavour and protect jobs in the current economic and fiscal environment without the right growth, managed well.

The Temple Quarter Enterprise Campus is at the heart of the next phase of our growth and development strategy. It will facilitate an expansion in our research, enterprise and education activities in exciting areas that are important to the future prosperity of our city region. The new campus will also facilitate around 3,000 new purpose-built student beds over the next four years.

We have a choice as to whether we want to be a good regional university, or one of the best in the world. It is essential that our community fosters a strong sense of ambition and entrepreneurial spirit for our University, and for our city, in order that our institution prospers for the next century and achieves even greater things. Given the passion, ingenuity and collegiality I see on a daily basis, I am sure that it will.

We recently published our

We recently published our